NATS4 Biller Fees

Biller transaction fees tell NATS how much your biller is charging for each transaction. NATS4 allows you to set the fees and decide whether or not you want to deduct them from affiliate payouts. This is important, as setting correct fees will ensure an accurate profit/loss report in the reporting admin.

Setting Up Biller Fees

To set up your biller fees in NATS, navigate to the billers admin, and click the Set Biller Fees icon next to the biller you wish to edit. On the Biller Transaction Fees page, you will be able to configure transaction charges, as well as deduction fees.

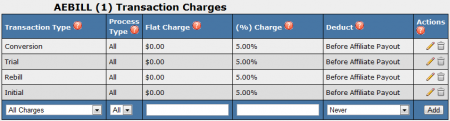

- Transaction Charges allows you to set biller fees for any type of sale, or positive transaction. This includes conversions, initial joins, rebills, trials, chargeback reversals, credit reversals, insufficient funds reversals, and void reversals.

- Note: If you limit the biller charges by transaction type or process type, it will override any fee for All Sales and/or All Process Types.

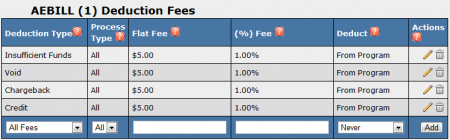

- Deduction Fees allows you to set fees for any negative income transactions. This includes chargebacks, credits, insufficient funds, and voids.

- Note: If you limit the deduction fees by transaction type or process type, it will override any fee for All Deductions and/or All Process Types.

While the two differ in how fees/charges are incurred, setup for both Transaction Charges and Deduction Fees is very similar.

To add a new Charge or Fee to NATS, use the available drop-down menus and empty fields at the bottom of each section.

Select your transaction/deduction type from the first drop-down menu, or apply a fee for all transactions or deductions. The next drop-down menu allows you to select what kind of processing type you want this change to affect (i.e., credit card, check, etc.). This is useful in case a biller has different processing fees for different payment types.

You will then have to enter the Transaction Charge/Deduction Fee amount. Here you can choose between a flat dollar fee, or a percentage charge of each transaction, depending on how your biller charges you. Simply input the flat charge or % charge in the available fields.

Deductions

The "Deduct" column chooses when NATS factors in the biller transaction charges and deduction fees. There are four Deduct options offered by NATS:

- Never - Deducts the biller fee from the affiliate or profit and loss report. This prevents your profit and loss report from reporting accurate losses.

- After Affiliate Payout - Causes the biller fee to be deducted only after affiliates in revenue sharing programs have received their share of a client's gross profit. Through this option, the entire biller fee is deducted from the client's profits.

- From Affiliate Payout - Causes the biller fee to be deducted directly from the payment an affiliate in a revenue sharing program receives. Through this option, the entire biller fee is deducted from the affiliate's payouts.

- Before Affiliate Payout - Causes affiliates in revenue share programs to be paid their share of the net profit after biller fees have been deducted. Through this option, the client and the affiliate split the biller fee equally.

Once you have filled out all necessary information for your transaction charge or deduction fee, click the "Add" button to put your charges into effect. To edit your charges and deductions, click the "Edit" icon in the Actions column. To delete your charges/fees, click the "Delete" icon in the Actions column.