Difference between revisions of "NATS5 Taxes"

| (One intermediate revision by the same user not shown) | |||

| Line 2: | Line 2: | ||

|show_billers_admin_section = true | |show_billers_admin_section = true | ||

}} | }} | ||

| − | NATS5 is able to account for different taxes based on country and region | + | NATS5 is able to account for different taxes based on country and region. You can also configure whether or not you want to deduct these taxes from your affiliate's payout. This is important, as setting correct taxes will ensure an accurate Profit & Loss Report in the Reporting section. <br><br> |

| − | |||

| + | == Tax List == | ||

| + | |||

| + | The list provides details for each Tax setting within your NATS. <br/> | ||

[[File:Taxes-Management.jpg|border|1000px]] | [[File:Taxes-Management.jpg|border|1000px]] | ||

| + | |||

== Adding a New Tax == | == Adding a New Tax == | ||

| Line 22: | Line 25: | ||

**''Before Affiliate Payout'': The fee is subtracted from the total transaction amount, and the affiliate's payout is calculated from the resulting net amount. | **''Before Affiliate Payout'': The fee is subtracted from the total transaction amount, and the affiliate's payout is calculated from the resulting net amount. | ||

| − | Once you are finished, click the "Add" button, and your tax will appear on the Taxes page. | + | Once you are finished, click the "Add" button, and your tax will appear on the Taxes page. |

== Editing & Deleting a Tax == | == Editing & Deleting a Tax == | ||

Latest revision as of 19:48, 7 August 2019

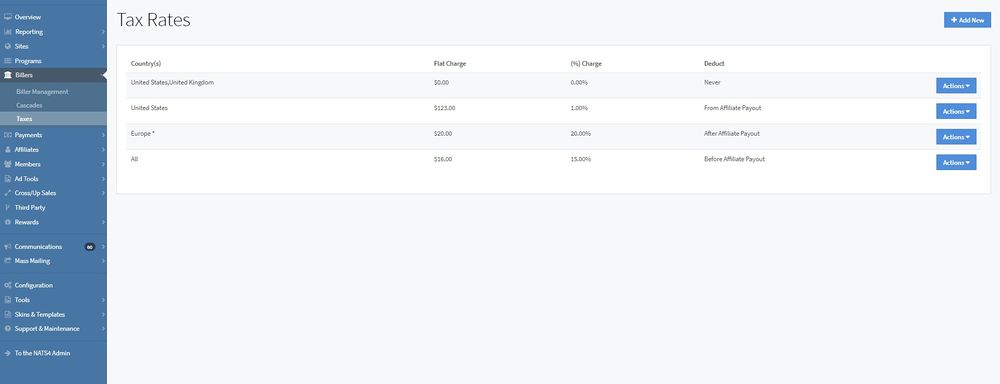

NATS5 is able to account for different taxes based on country and region. You can also configure whether or not you want to deduct these taxes from your affiliate's payout. This is important, as setting correct taxes will ensure an accurate Profit & Loss Report in the Reporting section.

Tax List

The list provides details for each Tax setting within your NATS.

Adding a New Tax

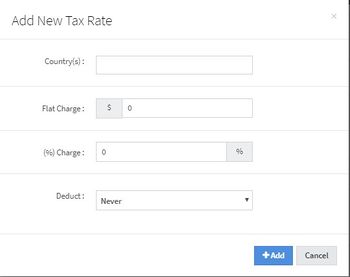

To add a new tax, click the "Add New" button at the top-right of the Taxes page. A widget will appear where you will be able to add a new tax.

The information to fill in includes:

- Country(s): The country(s) in which you would like to set up a tax.

- Flat Charge: A flat dollar amount that will need to be paid when coming across this tax.

- (%) Charge: A percentage of the transaction that will need to be paid when coming across this tax.

- Deduct: This tells NATS when to take the biller fees out of the payouts. The different deduction options include:

- Never: Calculate the fee, but never deduct it from affiliates nor your Profit/Loss

- After Affiliate Payout: Affiliate gets paid out first, then fees are deducted from your profit/loss completely.

- From Affiliate Payout: The affiliate payout is calculated, then the entire fee is deducted from their payout.

- Before Affiliate Payout: The fee is subtracted from the total transaction amount, and the affiliate's payout is calculated from the resulting net amount.

Once you are finished, click the "Add" button, and your tax will appear on the Taxes page.

Editing & Deleting a Tax

To edit a tax, click the "Actions" button next to the respective tax and click "Edit Tax". A widget, similar to the "Add Tax" widget, will appear that will allow you to edit any of the tax information.

To delete a tax, click the "Actions" button next to the respective tax and click "Disable Tax". This will permanently disable and remove the tax from your NATS.